what type of car loan can i get with a 700 credit score

Subprime borrowers on the other hand and those with lower credit scores dont fare as well. You may have a better auto FICO score than a normal FICO score so your car loan interest rate with a 700 credit score could be.

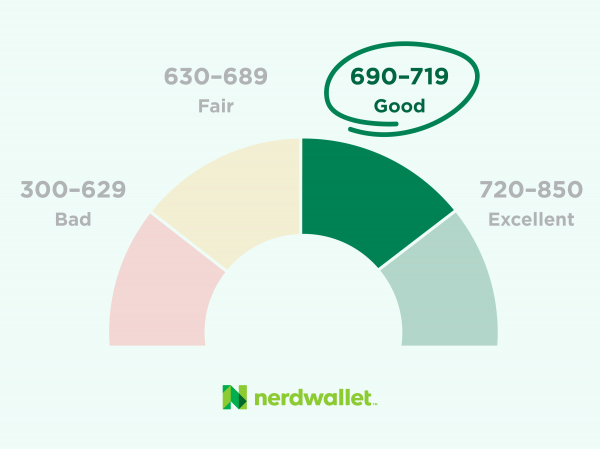

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

Ad Read Experts Review Compare Your Car Loan Options.

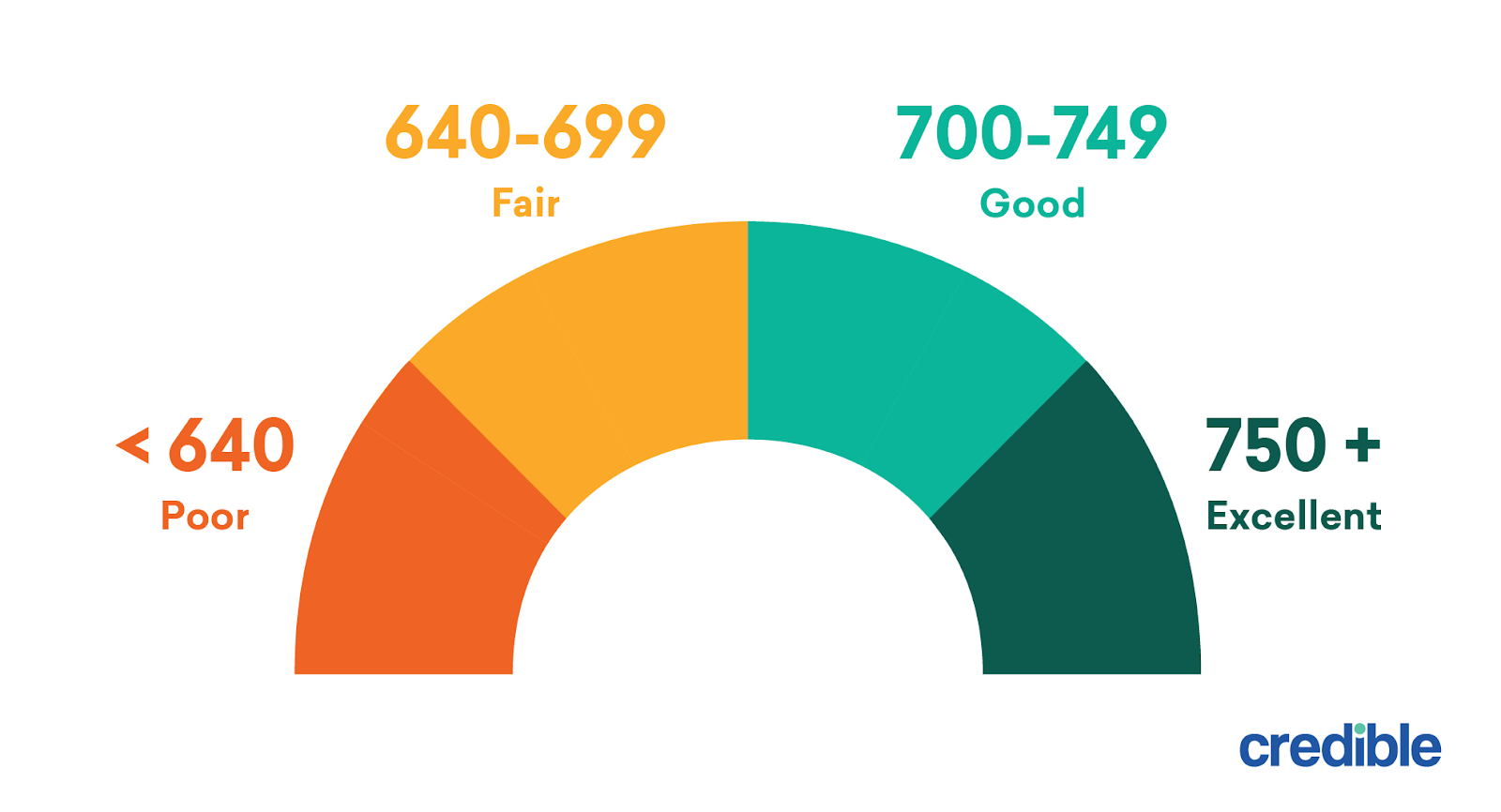

. Here are five reasons why you might get rejected even though you have a great score. Most lenders consider a credit score between 700 and 749 to be good but the lower cutoff can be. Yes you can get a car loan with 600 credit score.

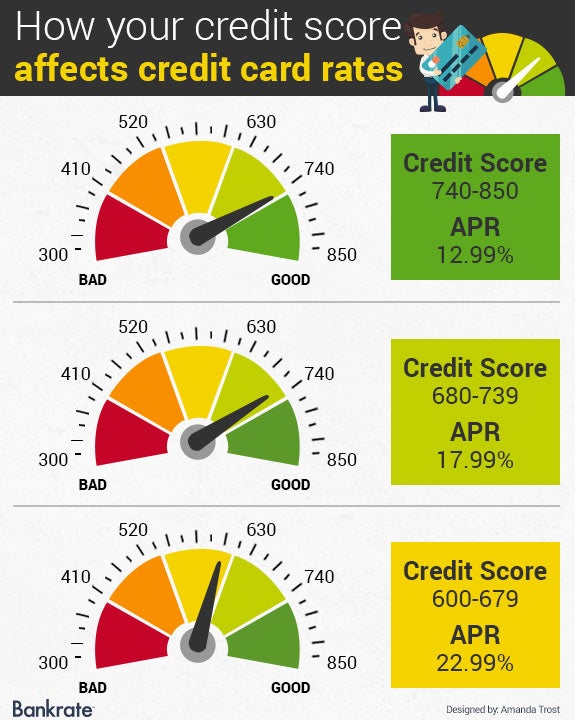

Your credit score can impact your maximum loan amount and the interest rate you receive on a loan or line of credit. However even with a score of 700considered a good. We Found The Best Car Loans - Phrase Rates For You.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. As of this writing here are some of the nations top auto lenders and the way they see credit scores of 700. 699 credit score is tier 3 Bank of the West - Tier 4.

Individuals with a 600 credit score can get a car loan but It may not be as easy as it is for someone with a score of 700 or above. Banks typically entertain loan applications from customers who show a credit score of 700 to 750. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the.

A 700 credit score meets the minimum requirements for most mortgage lenders so its possible to purchase a house when youre in that range. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. A 700 credit score puts you firmly in the prime range of credit scores meaning you can get a competitive rate as long as you shop around have good income and have a solid debt-to.

A 700 credit score puts you firmly in the prime range of credit scores meaning you can get a competitive rate as long as you shop around have good income and have a solid debt-to. This is how people end up with a 35000 loan for a 30000 car -- avoid this type of situation at all costs. When checking your credit score most lenders and institutions.

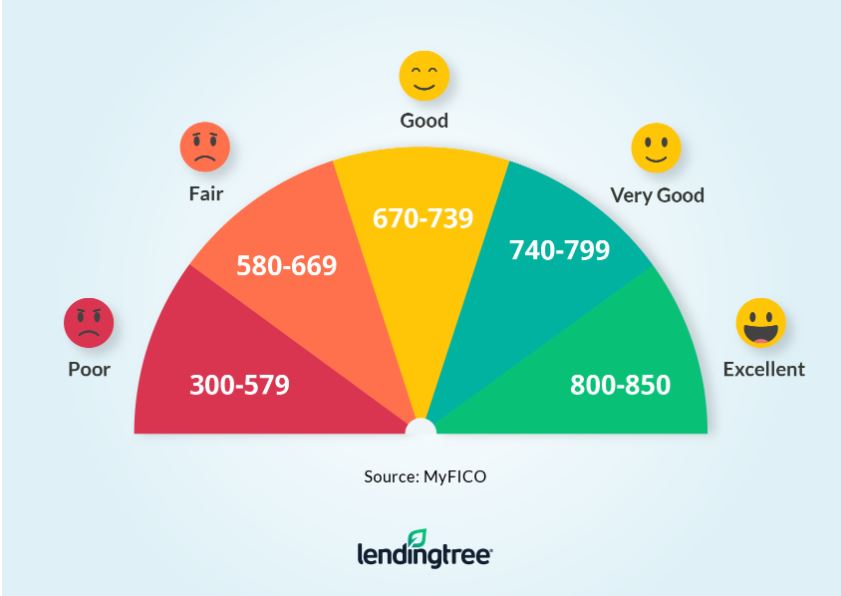

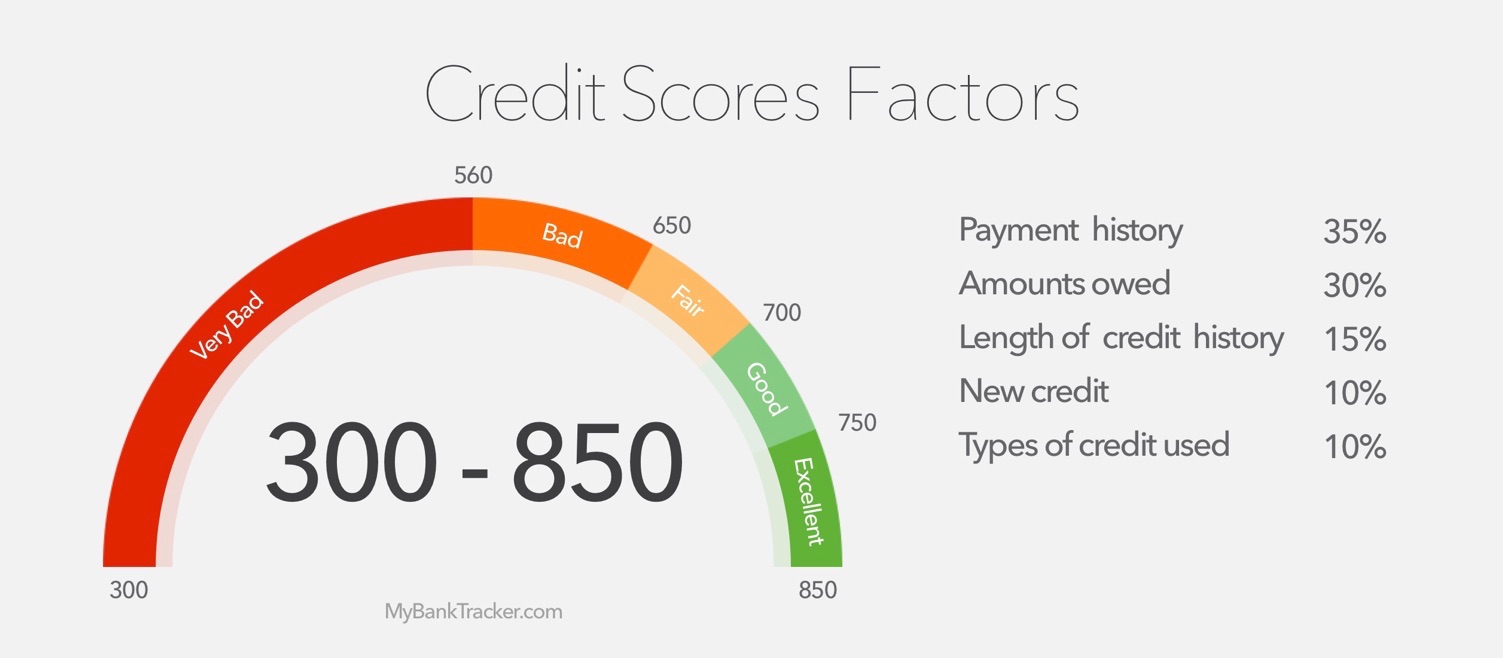

Bank of America - Tier 2. The average interest rate for a new car loan with a credit score of 700 to 709 is 351. Broadly speaking credit score ranges can be broken down along these lines.

What interest rate can I get on a car. Check our financing tips and find cars for sale that fit your budget. If you have a bad credit score you generally present a higher risk hence why your interest may be a lot higher.

Apply Today For Low Rates. However lenders look at more. Just keep all the information given above in mind.

Buyers with a credit score of between 500-589 for example are looking at interest. To be clear you can get a car loan with a low credit score. On average the credit score for a used-car loan or lease was 665 according to the data while the average score for a new-car loan or lease was 732.

Individuals with a 700 FICO credit score pay a normal 468 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 590-619 were charged. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. Many lenders will limit loans to a maximum of 5000.

Ad If you have bad credit no credit bankruptcies or even repos were the answer. Many lenders will limit loans to a maximum of 6000. When your FICO credit score falls around the 400 mark youre considered a deep subprime borrower.

Yes you can get a car loan with 600 credit score. Most dealerships will advertise plenty of incentives for buying a new vehicle such as. You are a gamer Credit card introductory bonuses can be lucrative.

Getting a loan with 450 credit score is possible. It doesnt matter how bad your credit history is we look at your potential to repay. Deep subprime is the lowest credit tier but you may still have car loan.

For example if your credit score is 575 your pre-tax monthly income is 2500 and your rent is 700 per month the loan calculator estimates youd be eligible for a 20000 loan. Click Get Exclusive Offers Now. Below that you can go to credit unions or.

A 700 credit score puts you firmly in the prime range of credit scores meaning you can get a competitive rate as long as you shop around have good income and have a solid debt-to. A 700 credit score puts you firmly in the prime range of credit scores meaning you can get a competitive rate as long as you shop around have good income and have a solid. The report also found.

15 of gross monthly income. Individuals with a 500 FICO credit score pay a normal 148 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 300-499 were charged. Here are five reasons why you might get rejected even though you have a great score.

What You Need To Know About Your Credit Score Kia Victoria

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

What S The Minimum Credit Score For A Car Loan Credit Karma

How To Qualify For A Powersport Loan Lendingtree

What Credit Score Do You Need To Get A Car Loan

How To Get A Car Loan With No Credit History Lendingtree

Is 700 A Good Credit Score To Buy A Car Green Light Auto Credit

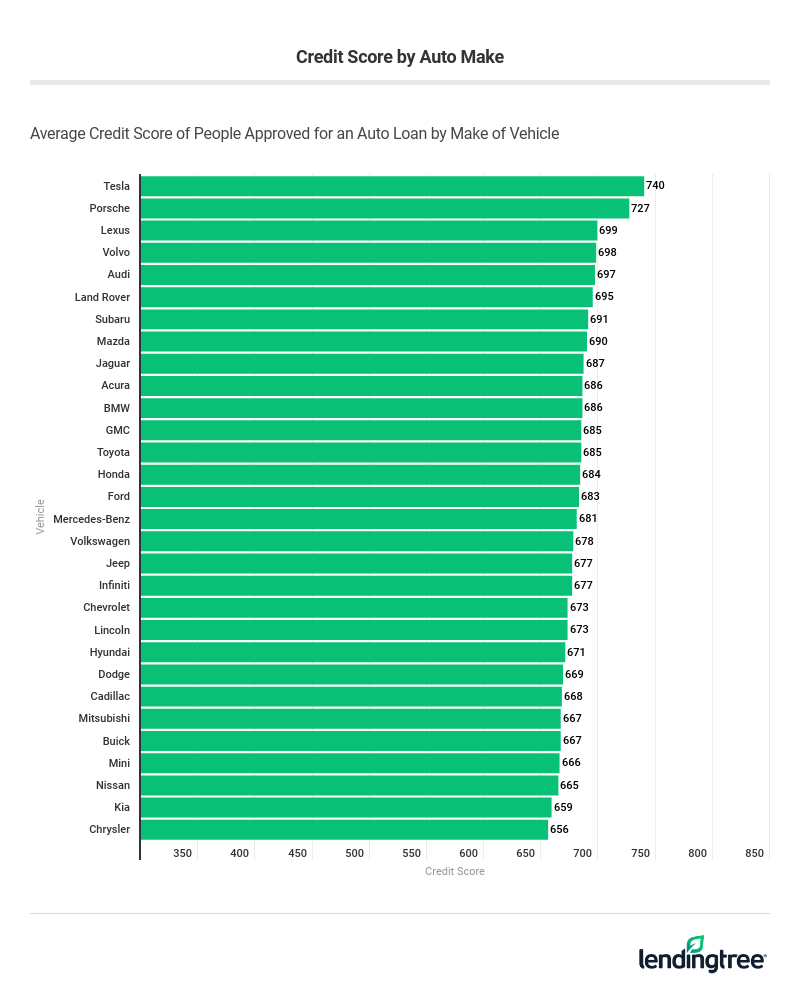

The Auto Makes With The Highest Average Credit Score Lendingtree

8 Best Loans Credit Cards 650 To 700 Credit Score 2022

Understanding Your Credit Score And Why It Matters Envision Financial

How Parents Can Help Their Children Build Good Credit Mybanktracker

What Is Considered Bad Credit Legacy Auto Credit

700 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

What Are The Credit Score Requirements For An Auto Loan Credit Sesame